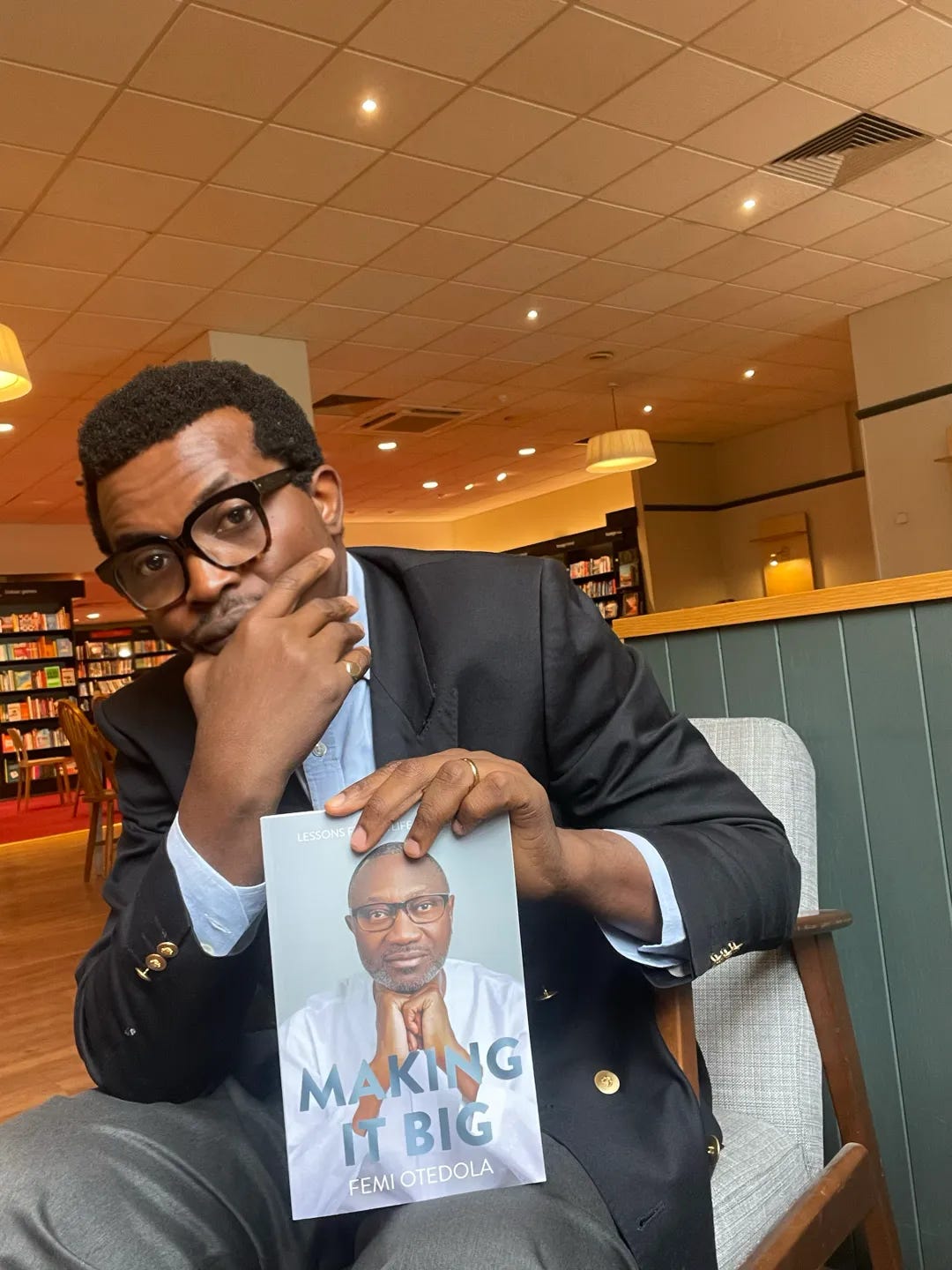

He owed the banks 200 Billion and he bounced back

I just finished reading the 280 page book MAKING IT BIG by Billionaire Femi Otedola.

Here are my notes:

On Hard Work

I wanted leverage, not handouts. So I sold, delivered, supervised, chased payments, and slept a few hours a night. I sat at depots till 2–3 a.m., then showed up again at 6 a.m. That obsession put my ships first in the loading queue and my company first in the minds of big buyers. Hard work didn’t just build Zenon—it made me the “king of diesel.”

Do this:

Outwork the bottleneck hours in your industry (when others sleep, ship).

Be physically close to the chokepoints where decisions and allocations happen.

On Starting Early (And Small)

A nail-trimming hustle taught me to sniff opportunity, sell value, keep records, and save. Start before it’s “perfect”—value now beats perfect later. Use every advantage you have (networks, proximity, trust).

Do this:

Launch a micro-offer this week. Charge something. Issue receipts. Track outcomes.

On Doing Things That Don’t Scale

I delivered diesel door-to-door in jeans and a polo while friends joked in nightclubs. Nothing was “beneath” me if it moved the dream forward.

Do this:

Personally run 10 unscalable touches for top prospects (hand deliveries, late-night supervision, on-site check-ins).

On Asking For Help (And Risk)

I borrowed £250k from my father at 1% and sold my mansion to buy trucks. Then I moved closer to bankers on Victoria Island—because billion-naira loans don’t get approved from across town.

Do this:

Trade comfort for proximity: move your office or weekly routine closer to capital and decision-makers.

On Multiple Streams & USP

From print jobs to petroleum to property, the income base widened—but the moat was quality + reliability. State-of-the-art machines. On-time delivery. Locked tanks for key clients. That became the USP.

Do this:

Write your one-sentence USP. Then operationalize it (SLA, inventory buffers, priority capacity for anchor clients).

On Reinvesting & Shunning Extravagance

Everything went back into the business—trucks, storage, tanks, people. Own the chain, reduce dependence, increase control.

Do this:

Reinvest a fixed % (e.g., 40%) of monthly net into capacity you control (inventory, infra, talent).

On Location (Increase Your Surface Area of Luck)

I relocated to Victoria Island and bought a base in Abuja. Deals prefer convenience. Power rarely comes to meet you in a hotel lobby.

Do this:

Be findable where money lives—co-work, dine, and meet in the “banker’s neighborhood.”

On Collections (Cash > Revenue)

When big clients delayed payments, I blocked gates and demanded cheques. No cash, no continuity. Principle and pressure saved the company.

Do this:

Put collections on a war-room board. Daily calls. Escalation scripts. Stop supply to chronic late payers.

On Supply Chain Control

A supplier once refused same-day product despite a long history. I found bulk sources, rented tanks, then built mine. Dependency is fragile.

Do this:

Map your top three single points of failure. Replace each with a redundant or owned alternative within 90 days.

On Breakthroughs (Be Ready)

A late flight encounter with the NNPC diesel chief changed everything—because I had my pitch, numbers, and nerve ready.

Do this:

Keep a 90-second “big ask” pitch saved on your phone. Update monthly.

On Paying For Expertise

I paid eight figures for world-class consultants before acquiring Geregu Power. I also retained ex-Mobil leadership to rebuild Forte.

Do this:

Budget “brains”: 5–10% of capex into research, due diligence, or veteran operators who’ve already built what you want.

On Deal-Making

I hired Julius Berger to build my office and house—on the condition I’d supply all the diesel. Then we netted diesel invoices against construction costs. One agreement became two profit centers.

Do this:

For every contract, design a second revenue stream: supply, maintenance, financing, or exclusivity.

On Hiring (Headhunt Like You Mean It)

I poached Akin Akinfemiwa and let him structure the business, then brought in KPMG/PwC. Recommendations are fine, but headhunting for exceptional people is a contact sport.

Signals I watch for:

Entitlement after a win (the “new car syndrome”).

Loose lips (the “sandwich test”).

Disloyalty in small asks (won’t help when it matters).

Why people stay:

Fair pay, clear respect, and no “eye-service” culture. Eight productive hours beat 16 performative ones.

Do this:

Build a list of 10 “impossible” hires. Court them for a year. Pay a premium for #1.

On High Standards (Only The Best Will Do)

Prime locations (Ikoyi, VI, Maitama). Top architects and builders. Luxury finishes. Excellence as default makes sales and rentals inevitable.

Do this:

Define your non-negotiables (vendors, materials, QA). Publish them. Enforce them.

On Studying Winners

I reverse-engineered competitors through public financials, watched stock moves daily, and learned from Rockefeller, Ford, Honda, Kroc, Gates—and from Nigerian industrial giants I could actually visit.

Do this:

Pick five public comps. Read their last 4 quarters’ reports. Track margins, inventory turns, and cash conversion cycles.

On Giving (And Grit In Crisis)

Oil crashed. Debt hit ₦220B. I surrendered assets to AMCON and started again. Kept my name. Kept my word. Kept going. Then I bought back AP shares cheap when everyone panicked.

Do this:

Protect your reputation like oxygen. When the lifeboat appears, take it—then rebuild with speed and focus.

On Haters

If you’re breathing, you’ll have adversaries. Let them fuel you. Conspiracy can turn to fortune.

Do this:

Write down the three criticisms that sting. Turn each into a system improvement.

On Politics & Power

Access helps—but it doesn’t deliver product, build tanks, or collect cash. Influence opens doors; performance keeps them open.

Do this:

Build a clean “license to operate”: compliance tight, relationships warm, documentation immaculate.

On Goals, Routine, and Health

Quarterly targets. Tight calendars. Eight hours of sleep (when debt is gone). Daily 700 calories burned. Curated news diet. Discipline compounds.

Do this:

Plan your next quarter by the hour. Lock in workouts. Set three financial KPIs and review weekly.

The Playbook (Condensed)

Work where the bottleneck lives.

Start tiny; sell value now.

Do the unscalable personally.

Ask boldly; risk intelligently.

Reinvest into control points.

Move closer to capital.

Collect cash with backbone.

Own supply; create redundancy.

Pitch ready—always.

Buy top brains before big bets.

Stack deals inside deals.

Headhunt A-players; pay for them.

Enforce high standards in everything.

Study winners via public numbers.

Give, rebuild, and keep your name clean.

Let haters power the engine.

Use access, but let performance speak.

Live by the calendar; protect your health.

Your Assignment (this week)

Collections sprint: Recover 20% of outstanding receivables.

Headhunt move: Message one “impossible” hire with a crisp, elite offer.

Control lever: Identify one dependency and replace it with an owned asset or second supplier.

Deal-within-deal: Propose an add-on revenue clause to one current contract.

Proximity shift: Book two meetings in the banker/executive district.

When comfort calls, remember: the trucks that leak oil also leak opportunity—if you’re the one willing to clean up, organize, and deliver better. That’s how you make it big.

LATEST PODCAST AND YOUTUBE VIDEO